Why IT are the big winners this F1 season

April 6, 2023

The 2023 Formula 1 season is just starting to rumble into life and as the travelling circus begins the journey from Melbourne to Azerbaijan we are going to take a look at the 300+ sponsors across the sport.

Our F1 Sponsorship Index powered by caytoo analyses all the sponsors across the sport to see how the landscape has changed and the key sectors that the individual teams should be prioritising.

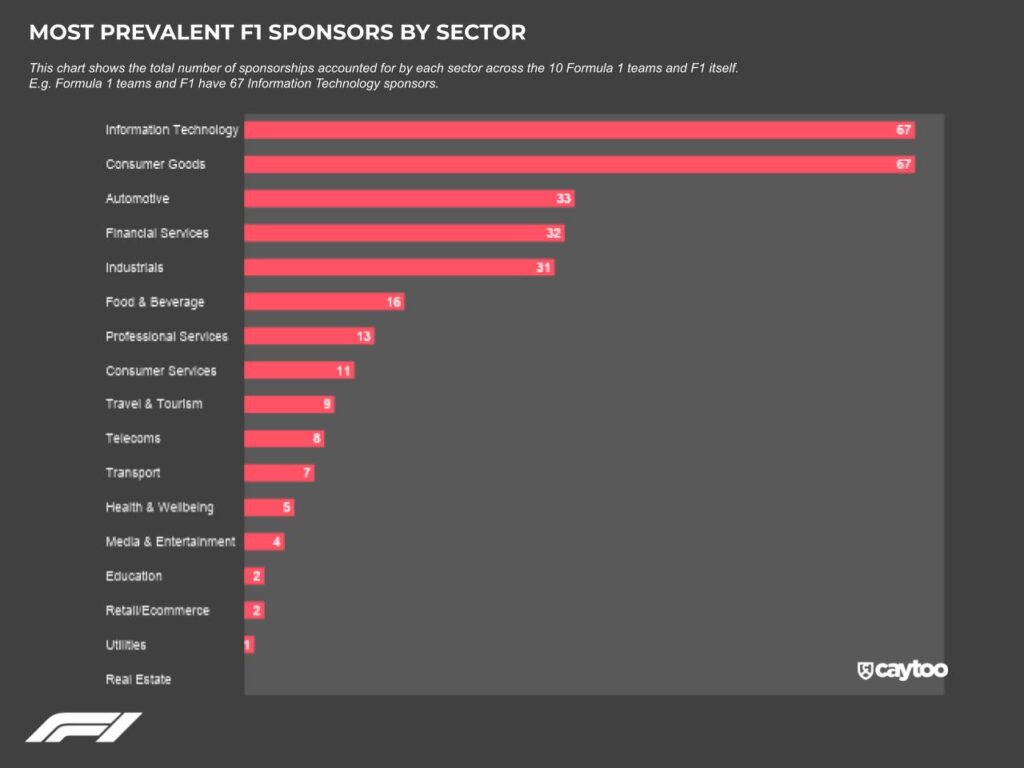

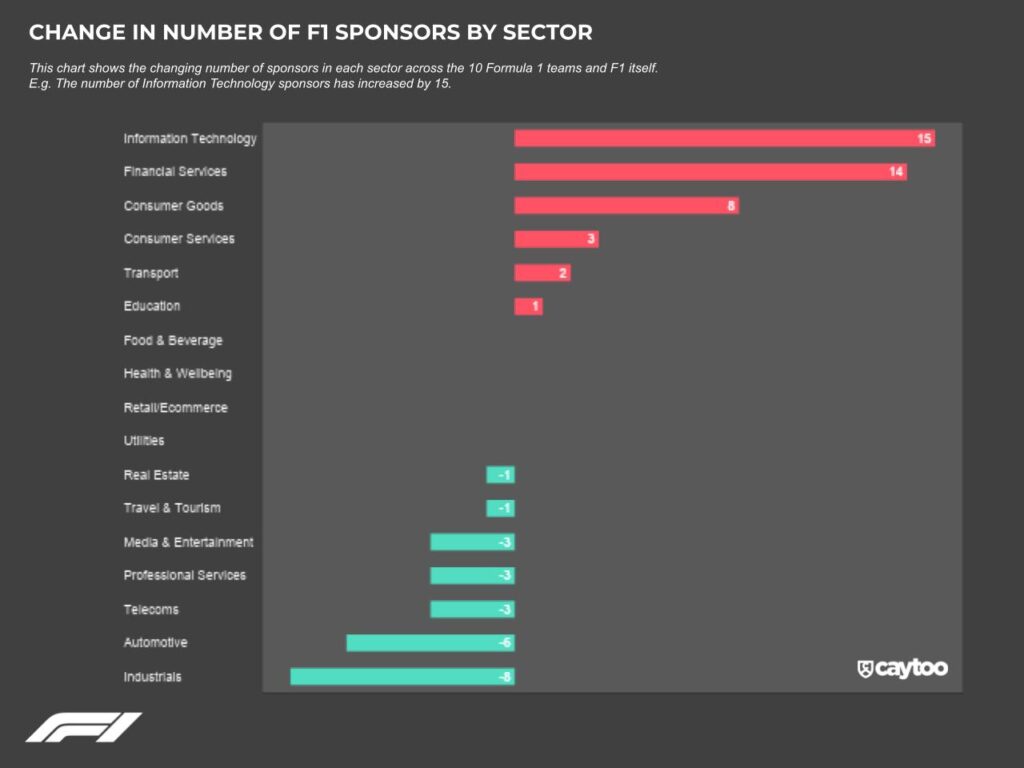

Over the last nine months, the 10 Formula One teams and F1 itself have signed nearly 14 new sponsors per month. In that period, Information Technology has seen the biggest increase in the number of sponsors (+15), narrowly ahead of Financial Services (+14) and Consumer Goods (+8).

IT’s growth was driven by both Software (now the No. 1 sub-sector, up from No. 4) and Cybersecurity brands; Financial Services growth was driven by Investment/Trading brands (up from No. 12 to No. 7) while Consumer Goods was driven by Accessories brands such as luggage and sunglasses.

The growth of these sectors is driven by the brand rationale of ‘showcasing capability’ as a reason to undertake the sponsorship.

IT is a particularly natural bedfellow for F1 in this regard; technology powers the sport and so many partnerships are technical supply or value in kind deals. Cognizant (Aston Martin) and Oracle’s RedBull deal show that the tech can power the car and the partnership delivers for the brand. These true partnerships lower costs, provide technology and revenue for the team and brand assets for the partner. The demonstration of the technology in action adds authenticity by showing that it delivers elite performance.

Consumer Goods is also a natural partner; clothing, watches, sunglasses and luggage are crucial to the day to day lives of the drivers and the teams – its inherent globetrotting DNA – as well as reflecting the sport’s close links with fashion and some of the world’s most glamorous locations.

Data correct as of February 22nd.

Let’s get into the index: