Titans and Disruptors: A Market Cap Analysis of the Sports Business Landscape

June 27, 2024

Carlo De Marchis “A Guy With A Scarf” pens down this month’s Business Index.

In the dynamic world of sports business, market capitalization serves as a key indicator of a company’s perceived value and future potential. A recent analysis of market caps across various sectors of the sports industry reveals a landscape dominated by tech giants, challenged by emerging players, and marked by significant disparities in scale.

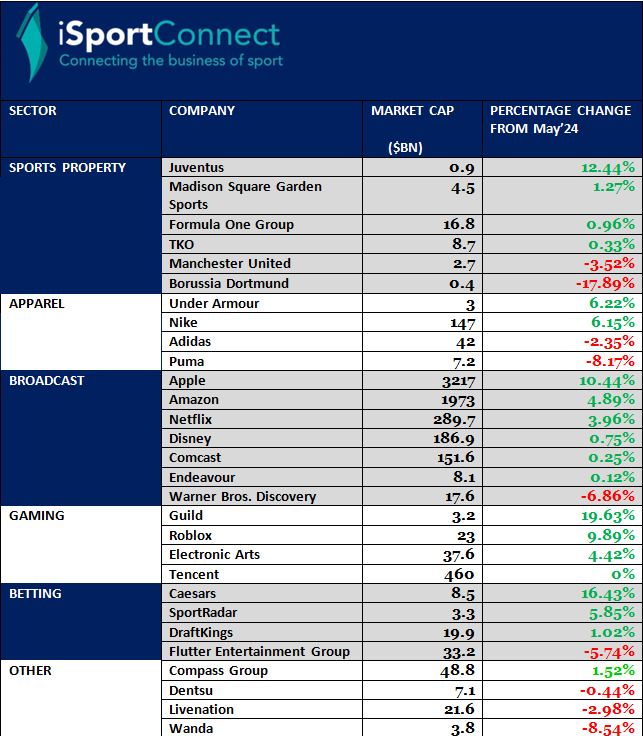

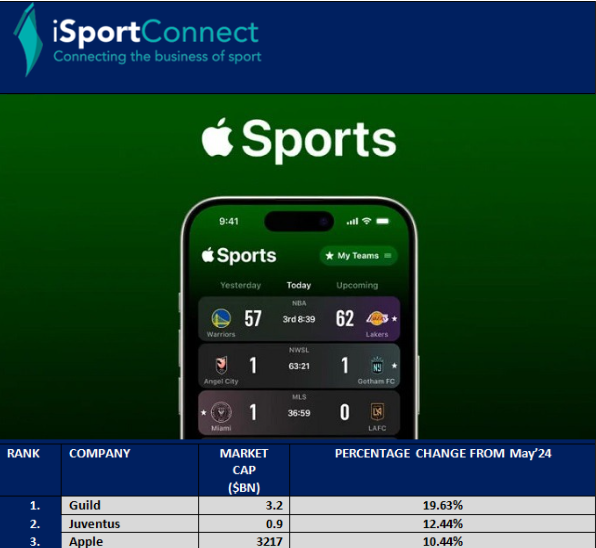

At the apex of this ecosystem sits Apple, with a staggering market cap of $3.22 trillion as of June 24th. This tech behemoth, while not a pure-play sports company, has become increasingly influential in the sports world through its streaming capabilities and partnerships. Its 10.44% growth from the previous month underscores the growing importance of tech platforms in sports content distribution.

Following Apple, we see Amazon ($1.97 trillion) and Disney ($186.9 billion) as other major players straddling the line between tech, media, and sports. These companies’ market caps dwarf those of traditional sports properties, highlighting the increasing convergence of sports with broader entertainment and technology sectors.

In the realm of pure sports properties, Formula One Group leads the pack with a market cap of $16.8 billion, showing a modest 0.96% growth. This figure, while impressive within the sports industry, illustrates the vast scale difference between traditional sports entities and the tech giants now shaping the sports media landscape.

The disparity in market caps becomes even more pronounced when we look at individual sports teams. Manchester United, one of the world’s most recognized sports brands, has a market cap of $2.7 billion – less than 0.1% of Apple’s value. The 3.52% decline in United’s market cap, contrasted with Juventus’s 12.44% growth (to a market cap of $0.9 billion), demonstrates the volatility inherent in sports team valuations.

In the apparel sector, Nike maintains its dominant position with a market cap of $147 billion, dwarfing competitors Adidas ($42 billion) and Puma ($7.2 billion). Nike’s 6.15% growth compared to Adidas’s 2.35% decline and Puma’s 8.17% drop suggests a consolidation of power in the sports apparel market.

The emerging sectors of gaming and sports betting present an interesting contrast. While their market caps are generally smaller than traditional sports entities, their growth rates are often higher. Roblox, for instance, saw its market cap grow 9.89% to $23 billion, while DraftKings grew 1.02% to $19.9 billion. These figures, while far from the trillion-dollar valuations of tech giants, represent significant value in rapidly growing sectors.

Perhaps most telling is the comparison between sectors. The combined market cap of the six sports properties listed (Formula One, TKO, MSG Sports, Manchester United, Juventus, and Borussia Dortmund) totals approximately $34 billion. This figure is dwarfed by Nike alone, and is less than 10% of Netflix’s $289.7 billion market cap.

This disparity doesn’t necessarily indicate a decline in the popularity of sports. Rather, it reflects a shift in how value is created and captured in the sports business ecosystem. While live sports remain a premium content asset, the platforms that distribute this content and the companies that leverage sports for marketing are often capturing a larger share of the total value.

The betting sector provides another interesting perspective. Flutter Entertainment Group, with a market cap of $33.2 billion, is approaching the combined value of all the sports properties in our index. This underscores the growing economic importance of sports betting and its potential to reshape the financial dynamics of the sports industry.

Looking ahead, these market cap figures suggest several key trends:

1. The increasing influence of tech and media companies in shaping the sports business landscape

2. The potential for consolidation in sectors like apparel, where scale seems to provide significant advantages

3. The rise of gaming and betting as major value drivers in the sports ecosystem

4. The challenge for traditional sports properties to grow their valuations in a rapidly evolving market

For investors and industry leaders, these trends present both challenges and opportunities. Traditional sports entities may need to innovate and form strategic partnerships to compete with tech giants and capture more of the value they create. Meanwhile, emerging sectors like esports and sports betting may offer high-growth potential, albeit with higher risk.

In conclusion, the market cap analysis of the sports business landscape reveals an industry in transition. While the passion for sports remains as strong as ever, the business models and value chains are evolving rapidly. Success in this new environment will require agility, innovation, and a willingness to challenge traditional boundaries between sports, entertainment, and technology.

Here’s the full index: