The Bottom Line: how market volatility is impacting sport – March 30

March 30, 2023

In this month’s iSportConnect Business Index Ian Whittaker, Founder and MD of Liberty Sky Advisors, and twice City AM Analyst of the Year, explains the moves in this month’s index and looks into how general stock market volatility is affecting sport.

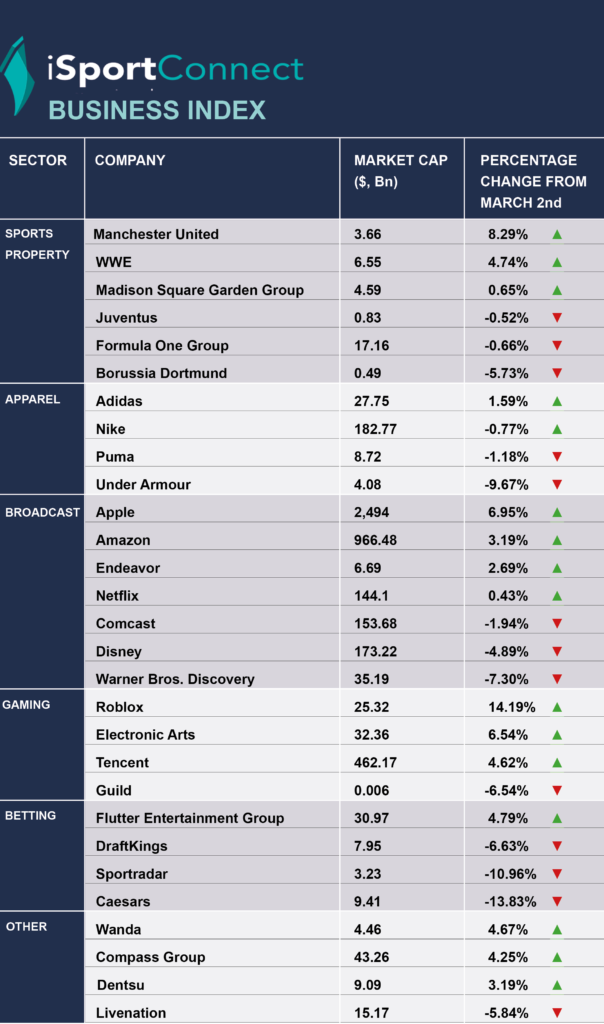

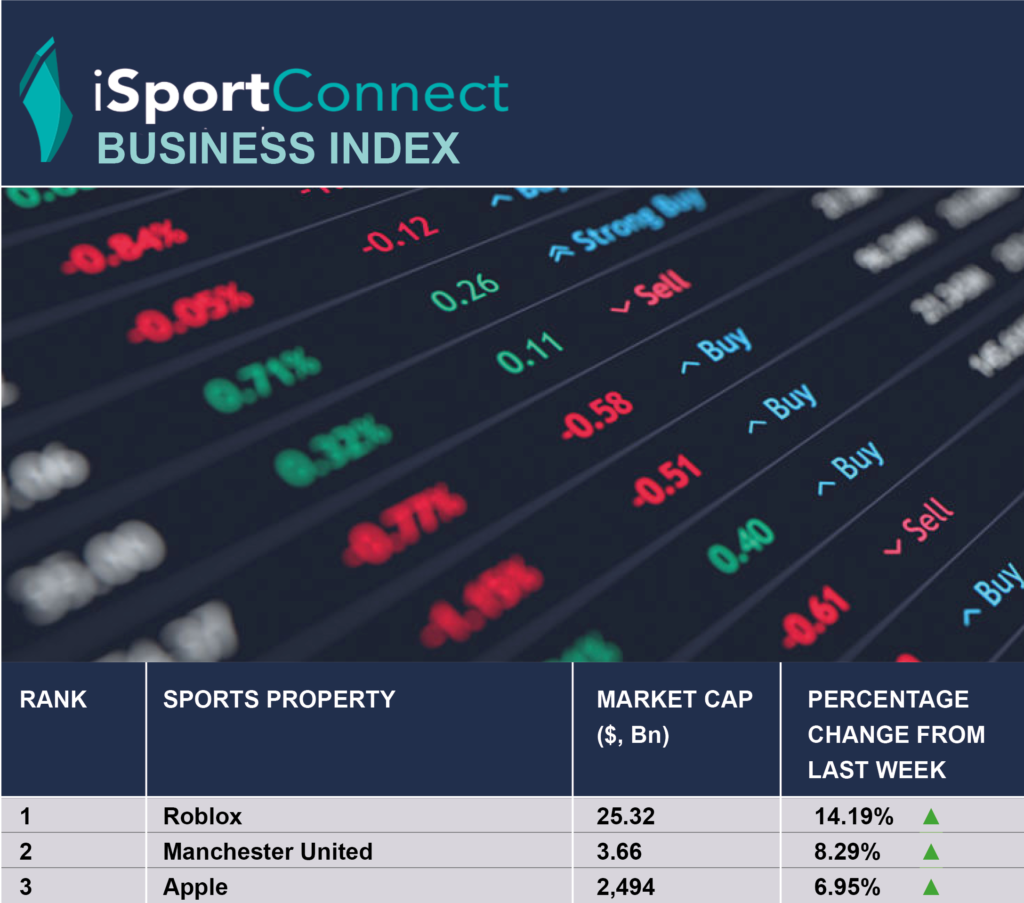

The stock markets have been volatile in recent weeks as the collapse of Silicon Valley Bank and the problems at Credit Suisse have dominated the headlines. As such, it has been a volatile month and that is reflected in the performance of the 30 names on our iSportConnect Top 30 stock list with a lack of uniformity even within sub-sectors. It is fair to say that Tech has probably been a beneficiary of the recent turmoil, part because of sector rotation as investor money came out of Banks and part because reduced expectations of interest rate rises is generally favourably to the sector as a whole. Apple is up nearly 7%, Tencent close to 5% and Amazon up over 3% against a S&P500 index that has barely risen. It is also being reflected in a healthy performance in the Games sector, with both Electronic Arts and Roblox performing well, although that reflects more a recovery versus previous lows than anything else.

Elsewhere, there is no uniform picture to say the least and stock specific factors tend to be the main driver rather than sector rotation. Dentsu, for example, has benefited from growing positive sentiment towards the Agency space but Live Nation has been impacted by recent lawsuits and negative press coverage. The main US Broadcast groups such as Disney and Warner Bros Discovery have suffered over concerns on TV advertising in particular while Netflix has remain flat. In sports property, unsurprisingly, Manchester United was the strongest performer in Sports Property, given the two competing bids for the club. WWE remains an attractive property given its strong franchise. Elsewhere the performance of sports properties were less good but it is worth remembering that names such as Juventus and Dortmund can have limited liquidity which can cause its own issues. That is not the case in the sports apparel sector, Adidas has been pummelled mainly due to the Yeezy debacle and the lost inventory but has regained some ground as investors hope the new CEO can turn things around. Some of that sentiment may be reflected in the poor performance of Puma, which had been as somewhat of a “safe haven”.

So, overall, there is no uniform picture for the numbers against a backdrop of a global economy where things remain uncertain but where the chances of a soft landing are increasing.

Let’s take a look at the index in full: