PwC’s 2021 Survey Highlights The Necessity Of Audience Knowledge

September 24, 2021

This week, PwC and iSportConnect came together once again for their annual Lausanne Summit in celebration of PwC Sports Survey 2021.

Due to the uncertainty of the past 18 months, competitions rearranged from 2020 are taking place in 2021, the disruption to sports around the world has meant that adaptability and sustainability is even more important according to this year’s survey.

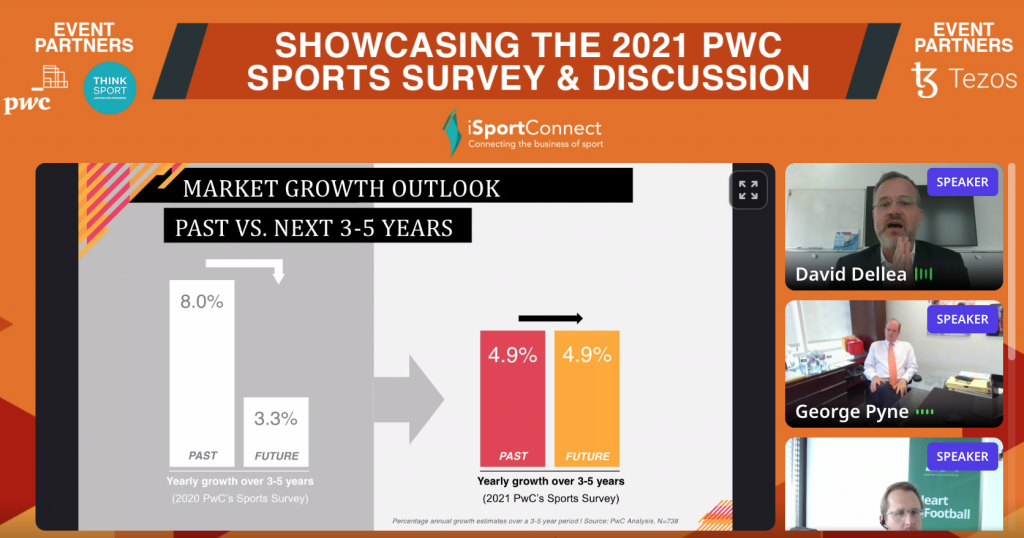

There has been a clear shift in market growth from the challenges of 2020 as the industry has taken strides to react to the pandemic.

As the graph below from Tuesday’s Virtual Summit illustrates, the market has gone from a decrease in the expected rate of growth in 2020, to anticipate a sustainable level of growth in 2021.

What is shining through is the fans – bringing value and engagement, enhancing brand awareness.

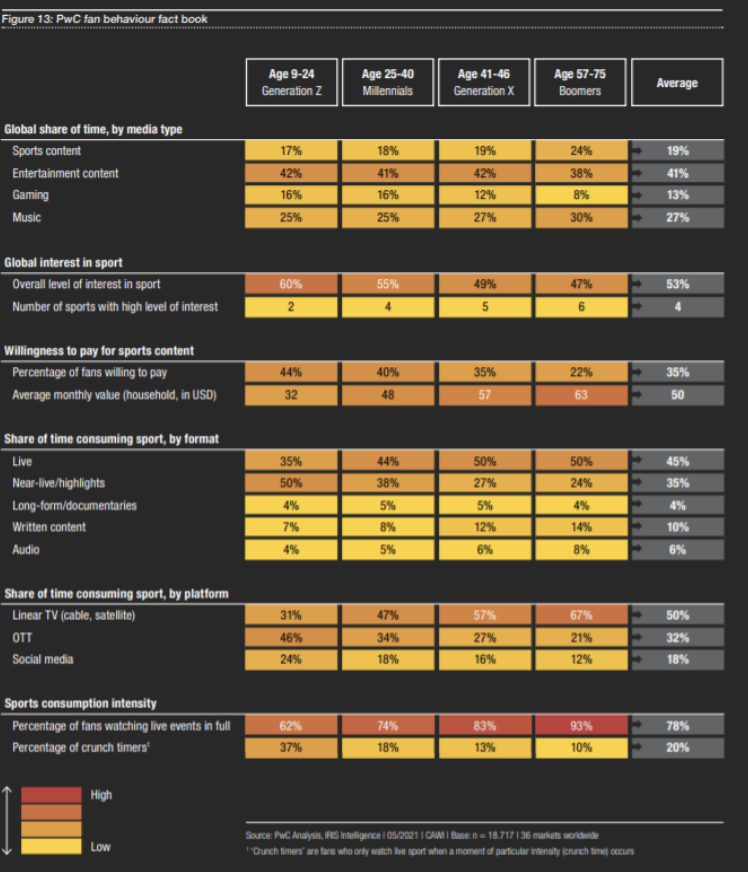

A growing factor that was consistently referred to throughout Tuesday’s event was how critical it is to look at generations and how different groups consume sports, instead of planning around business cycles.

The impact of changing fan behaviour needs to be taken into consideration when looking to engage fans with your sports.

As you can see in the “PwC Fan Behaviour Fact Book”, there is a reduced live sports consumption and lower level of interest in sport vs other entertainment content by Gen Z, compared to boomers. We’re also seeing more video gaming experiences inspired by sport to tap into the generational influence.

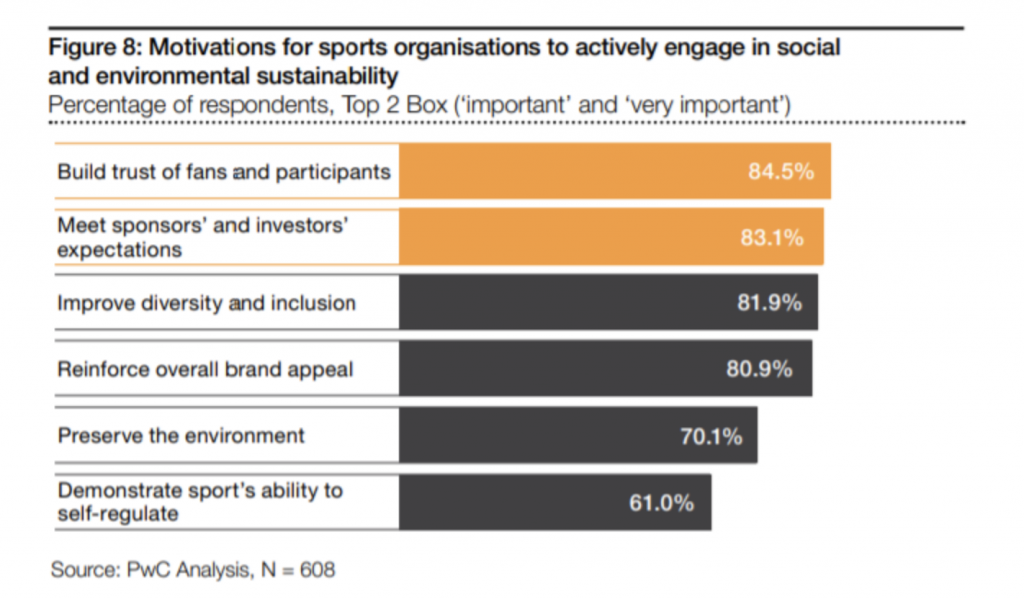

“Being a good human being is good business” – Paul Hawken

Connected to generations, there has been an increase in awareness of sustainability and inclusion, rippling into the sports industry. Identified by 84% of respondents, external stakeholder pressure is the primary driver for sports organisations to engage in social and environmental sustainability; most say that ESG is already part of their corporate strategy already.

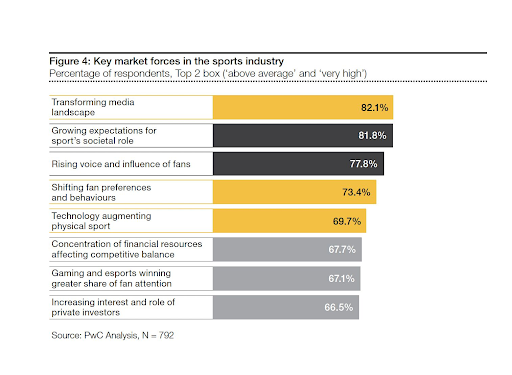

Prioritised by over 80% of executives from around the world finds a shifting media landscape, emphasis on the social role of sport and more voice from fans. 67% of respondents are optimistic about their ability to respond positively and feel prepared. Social issues and relatability give sponsorships more potential to support this movement in collaboration to strengthen their presence.

Overall, the PwC Sports Survey demonstrates that the industry is in a better position compared to the uncertainty of last year and have adapted and reacted well. Although rights owners and agencies estimate annual market growth at 4-6%, brands and media are more prudent with forecasts below 3%. Perceptions of the industry’s future growth vary considerably depending on the type of stakeholder.