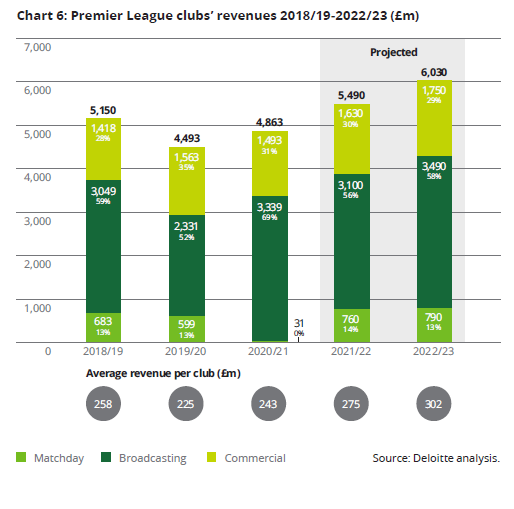

Premier League club revenues grew by 8% to £4.9bn, as per Deloitte’s Annual Review of Football Finance

August 18, 2022

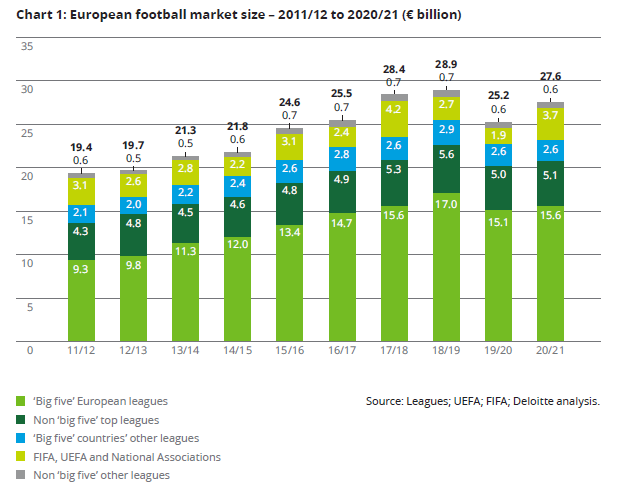

The European football market grew combined revenues by 10% (€2.4bn) in 2020/21 to €27.6bn – despite an almost complete absence of fans from stadia during the season – with the uplift largely driven by deferred broadcast revenues from the previous year and the success of the postponed UEFA EURO 2020 tournament.

As per Deloitte’s Annual Review of Football Finance, the ‘big five’ European leagues – the Premier League, Bundesliga, La Liga, Serie A and Ligue 1 – generated €15.6bn in revenue in 2020/21, a 3% increase from the previous year (€15.1bn in 2019/20). However, revenue polarisation between and within European football leagues continued at pace.

Largely attributable to deferred broadcast revenue, Premier League club revenues grew by 8% to €5.5bn in 2020/21. By contrast, the Bundesliga – which experienced the lowest uplift in aggregate broadcast revenue of the ‘big five’ in 2020/21 – reported a 6% fall in revenue to €3.0bn.

Revenues in Spain’s La Liga also contracted by 6% to €2.9bn. La Liga clubs collectively recorded a loss in operating profits for the first since the Sports Business Group began tracking this data on a club-by-club level, in the 2013/14 season.

Clubs in Serie A experienced the greatest percentage growth in aggregate revenues of any ‘big five’ league in 2020/21, increasing by 23% to a record high of €2.5bn. Driven by a 48% increase in broadcast revenue due to significant deferrals, it is the only league to have reported higher combined revenues than before the start of the COVID-19 pandemic.

Ligue 1 fell further behind Serie A in revenue terms, with the divide between the two league’s total revenues having doubled to over €900m. Ligue 1 clubs revenues grew by just 1% during the 2020/21 season to €1.6bn, as the curtailment rather than postponement of the competition led to very limited deferred revenue being recognised.

The Premier League was the only one of the ‘big five’ to report improved total operating profits in the year, cumulatively increasing from £49m to £479m. When excluding the Premier League the ‘big five’ reported increased total operating losses during the year, increasing from €461m to €901m.

Tim Bridge, lead partner in the Sports Business Group at Deloitte, said: “Clubs across Europe played a significant proportion of matches behind closed doors or with reduced capacity during the 2020/21 season which caused an almost complete loss of matchday revenue. It’s testament to the resilience of the industry, the value driven by broadcast deals and the success of the Euros that the European football market has achieved tenacious growth, in revenue terms, over the past year.

“However, it is important not to overlook the loss-making position of many clubs. The impact of the COVID-19 pandemic fundamentally changed the financial management of European football, with leagues and clubs having to seek external investment and responding to a shift in trends around transfer spending and club operations.

“Leaps made to boost financial sustainability through new UEFA regulations and to professionalise the women’s game will challenge clubs to break from tradition, potentially boosting profitability in a notoriously loss-making industry and creating a more inclusive environment for all. It is an exciting period, but one to be well prepared for.”

Deloitte’s analysis highlights a boom in investment across Europe’s ‘big five’ leagues, as clubs have sought and attracted investment at the very top level. Fifteen investments in clubs across the ‘big five’ leagues took place in 2021, more than in 2019 and 2020 combined (12). The vast majority (87%) of investments were made by high-net-worth individuals and private equity firms, with more than two-thirds of investments being made from the US.

Multi-club ownership (MCO) has grown in popularity, with over 70 MCOs now thought to be in existence, more than double the amount only five years ago (28). Nine of the 20 Premier League clubs operate within a MCO model.

Sam Boor, sports M&A advisory lead in Deloitte’s Sports Business Group, said: “Football is proving an attractive opportunity for a growing pool of international investors, whose confidence has been buoyed by clubs’ recovery post-COVID. To ensure that new investment brings value to all – those on the pitch, in the stands and in the boardrooms – the importance of responsible investment, which protects the financial and operational sustainability of clubs, cannot be overemphasised.”