iSportConnect Sponsorship Index: Your complete Premier League sponsorship breakdown

July 26, 2023

As we get closer to the start of a new Premier League season, we decided to turn the focus of this month’s Sponsorship Index, powered by caytoo, to the 20 teams which make up the league.

Sponsorship of Premier League teams is something that is in the news a lot at the moment because of Chelsea’s failure to find a front of shirt sponsor. This will be the first time they haven’t had a name on the front of their shirts since Gulf Air became their first shirt sponsor in 1983.

Another hot topic around the league is the banning of betting brands as front of shirt sponsors. The government-imposed ban will not come into effect until the 2026/27 season. Compared to ten months ago, one fewer club has a gambling sponsor and overall the number of gambling sponsors has dropped 18%.

We have looked into the partnerships held by each Premier League side to determine the key trends in sponsorship.

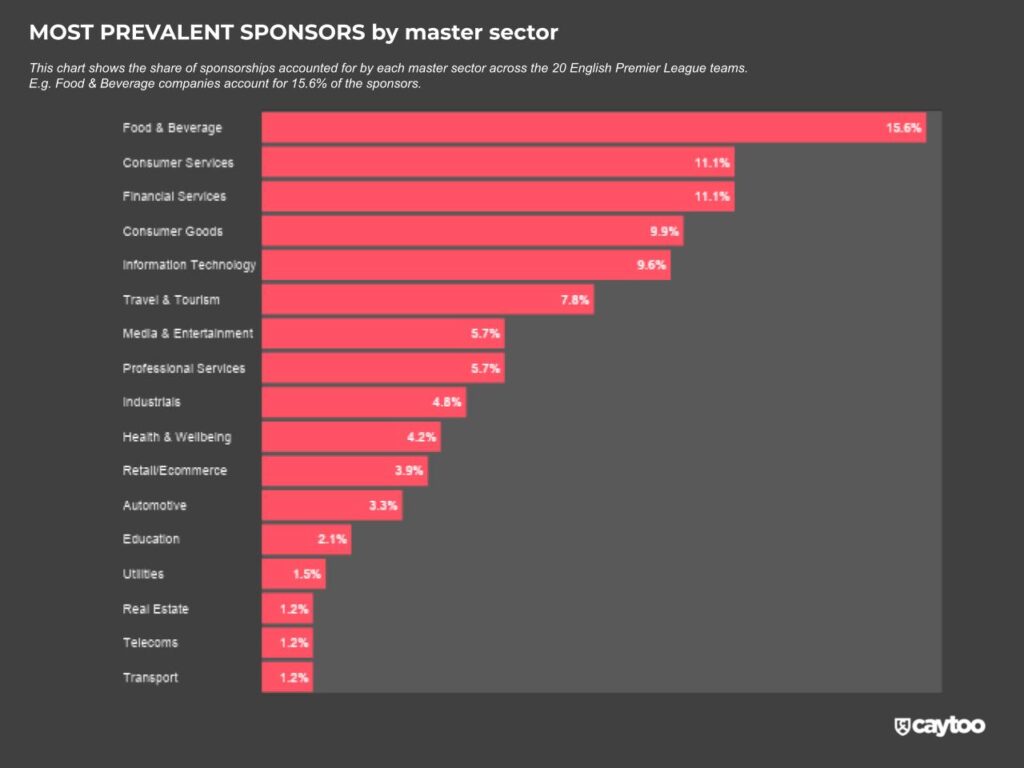

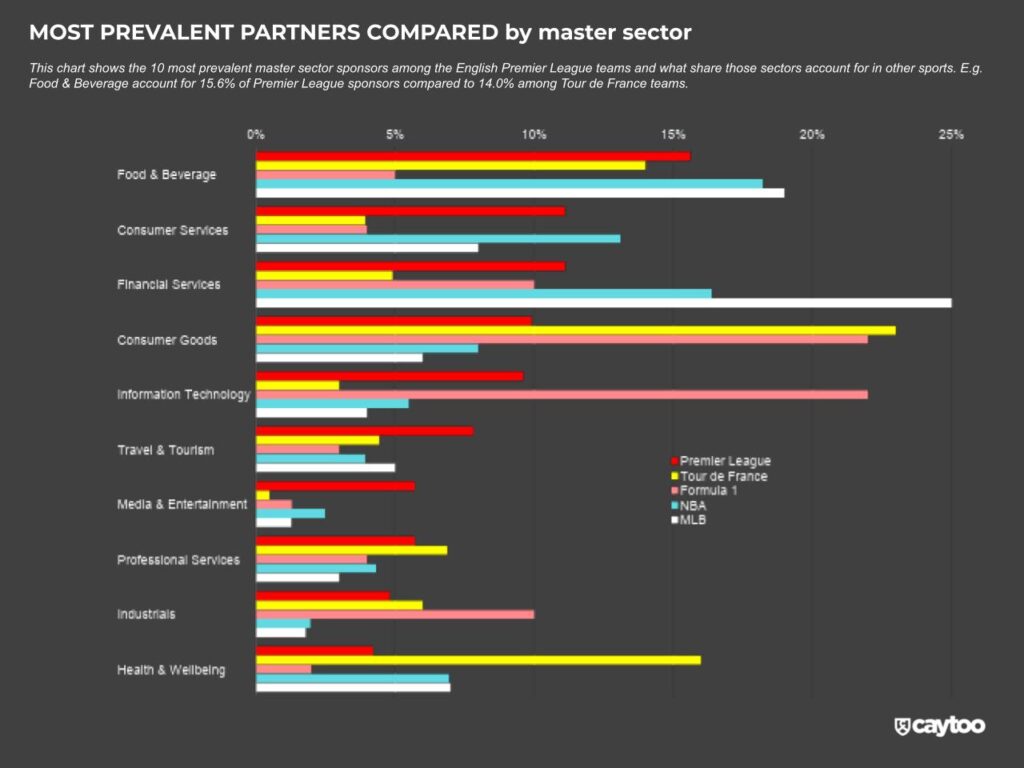

In a similar vein to the likes of the NBA and MLB, three sectors dominate sponsorship among English Premier League teams: Food & Beverage (accounting for 15.6% of sponsors and the three most common individual sponsors – Monster Energy, Cadbury and Heineken), Consumer Services and Financial Services (both 11.1%).

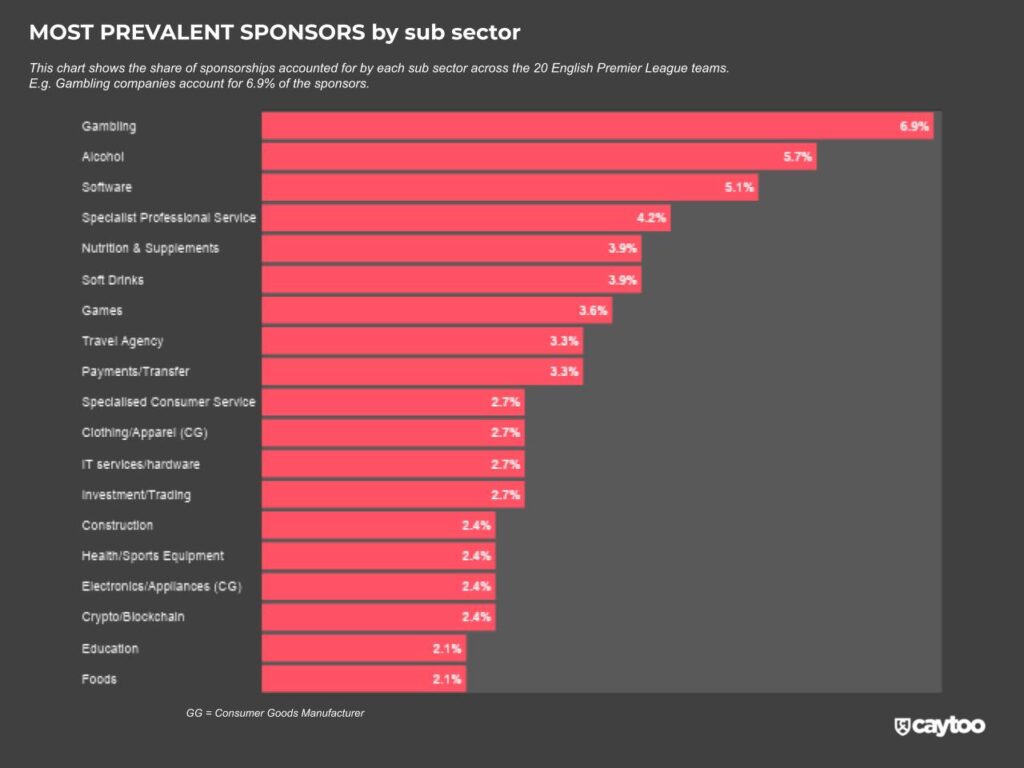

Food & Beverage is driven by Alcohol (5.7%, the 2nd most prevalent sub sector) and Soft Drinks and Nutrition & Supplements (both 3.9%) while Consumer Services is driven by Gambling (6.9%, the most prevalent sub sector). Financial Services is driven by Payments/Transfer (3.3%) and Investment/Trading (2.7%) firms.

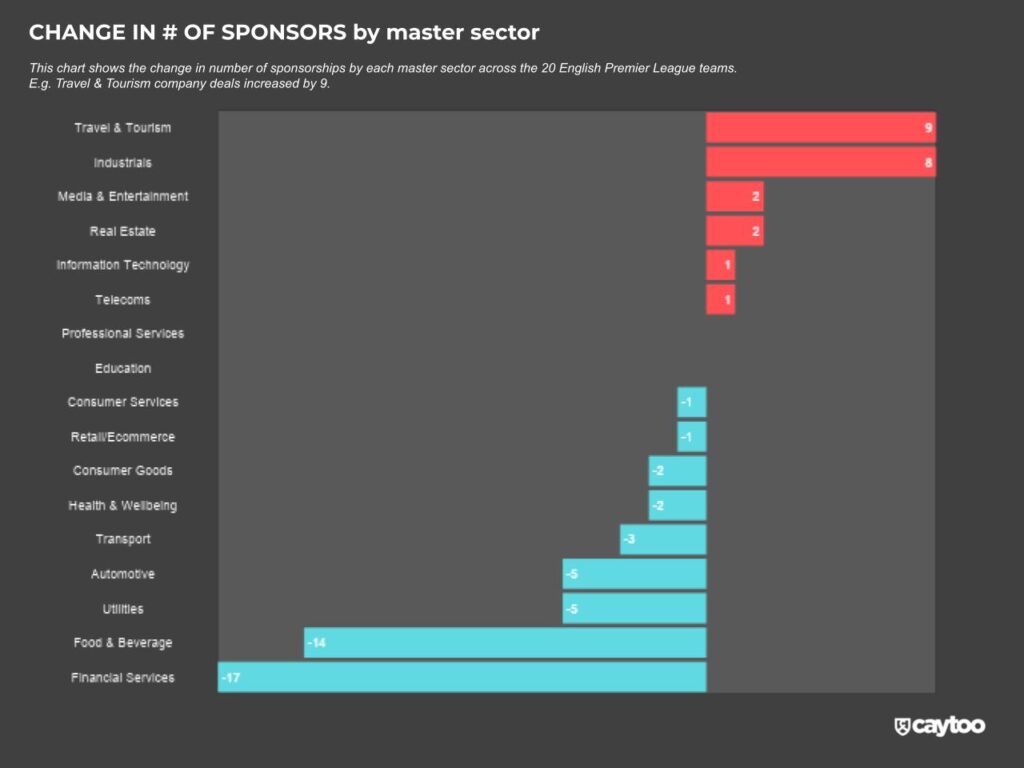

However, over the last 10 months, Financial Services and F&B have seen the biggest decline in the number of sponsorships, falling 31% and 21%, respectively. Financial Services’ decline has been down to Investment/Trading (a 40% drop in the number of deals, despite eToro’s recent splurge on PL teams to become the joint 4th most prevalent sponsor), Insurance (-44%) and Payments/Transfer (-27%). While F&B’s drop is down to Soft Drinks (-38%), Alcohol (-24%) and Foods (-42%).

This drop among traditionally dominant sectors such as Financial Services and F&B has resulted in a slight consolidation (or more even spread) of sponsors between the different sectors. For instance, 10 months ago, the difference between the most and least dominant sectors was 17.7 percentage points but this has dropped to 14.4. This suggests PL teams may be starting to do a better job at looking beyond the ‘usual suspects’ for sponsors.

In contrast, Travel & Tourism and Industrials have seen the biggest increase in the number of sponsorships, rising 53% and 100%, respectively. T&T’s growth – a trend identified by caytoo earlier this year – has been driven by Travel Agencies (up 83%), notably including Destination Sport Travel who sponsor three teams (Burnley, Tottenham Hotspur and West Ham United).