iSportConnect Sponsorship Index: Gambling, games and specialist business services lead the way among Champions League teams sponsors

September 21, 2023

With the group stages of the 2023/24 Champions League kicking off this week, we decided it was time to take a deep dive into the sponsors of the 32 teams with this month’s Sponsorship Index powered by caytoo.

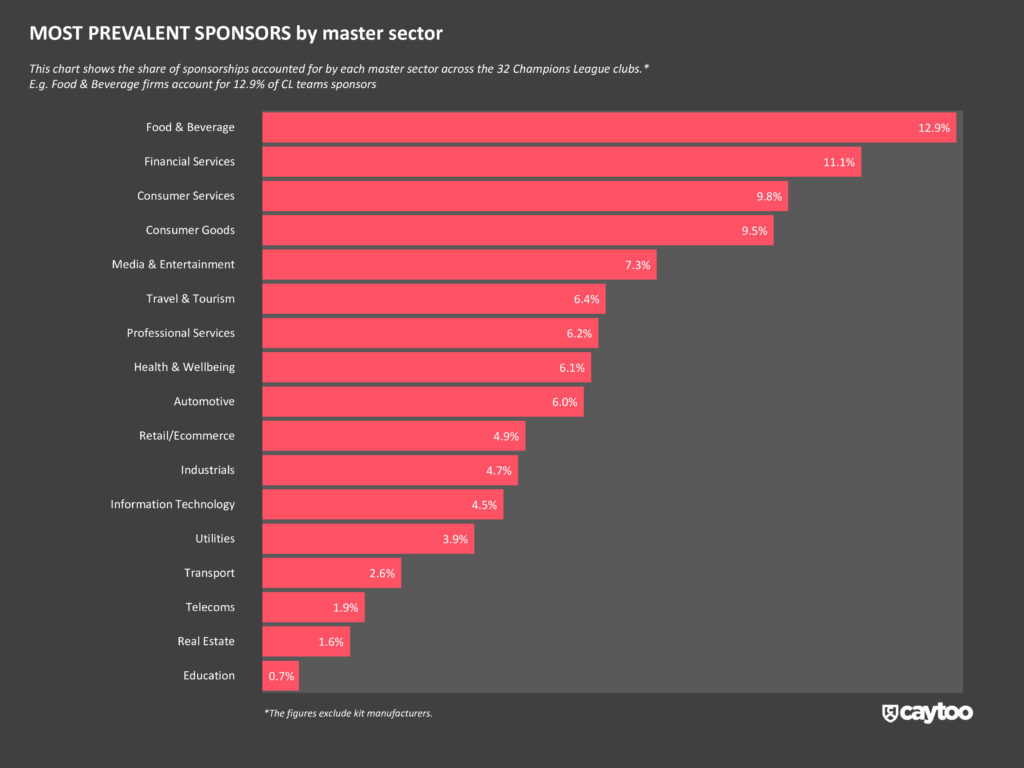

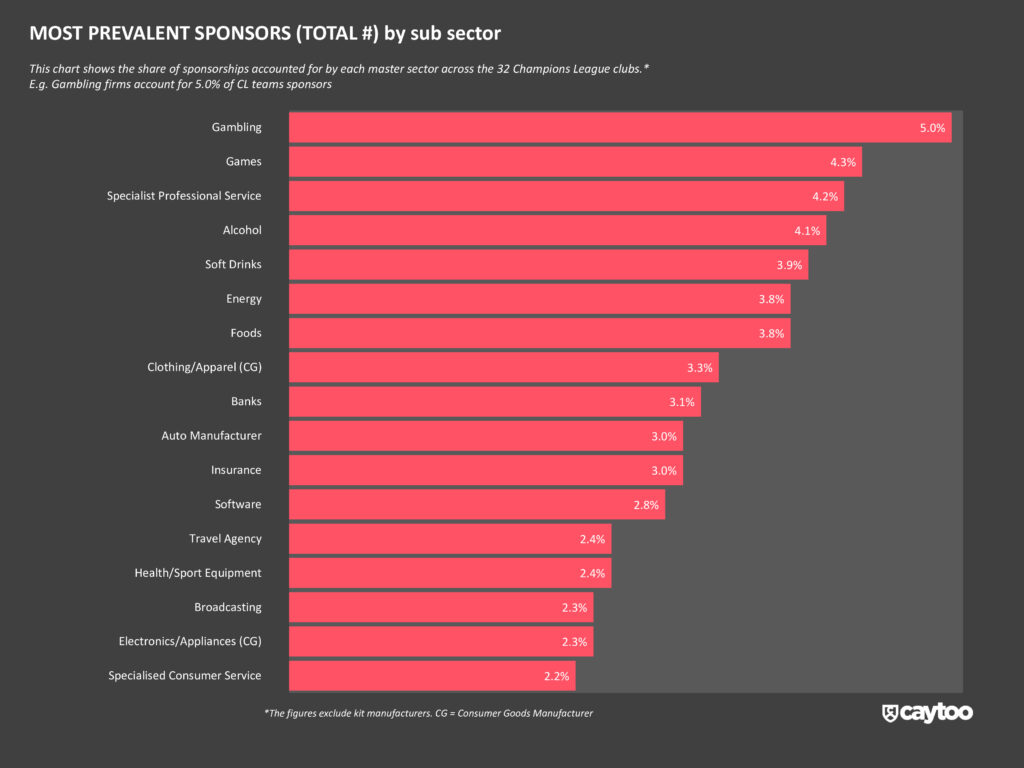

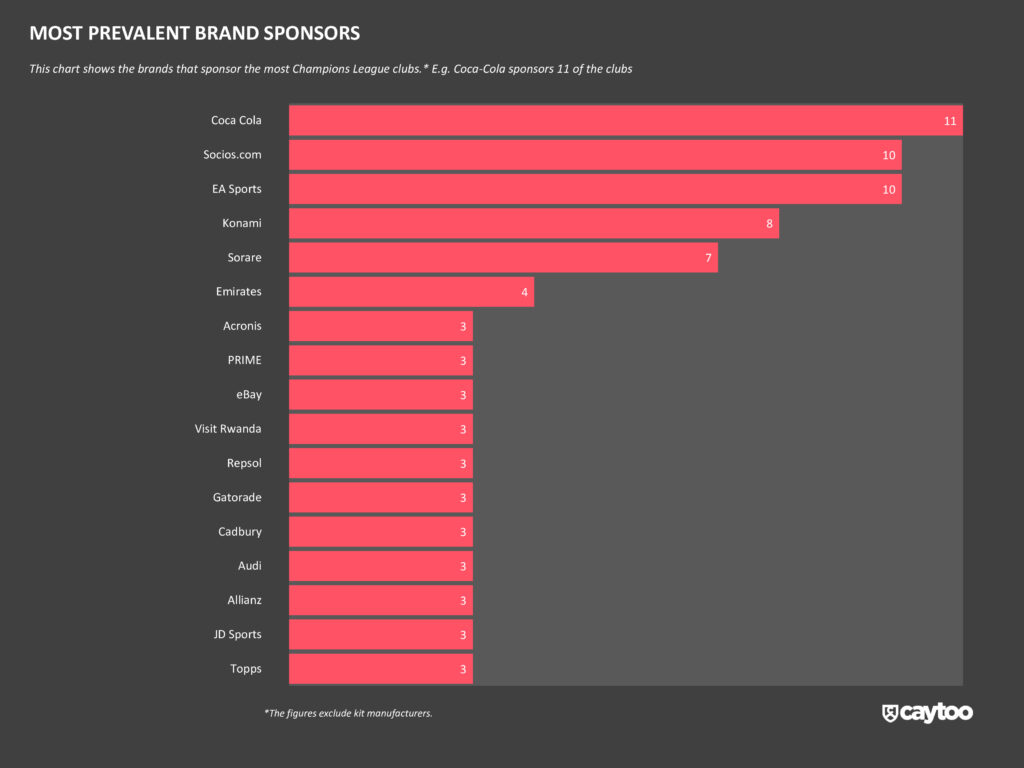

Food & Beverage is the most prevalent sector (at 12.9% share), just ahead of Financial Services (11.1%) and Consumer Services (9.8%). F&B is driven by Alcohol (4.1%), itself driven by beer, and Soft Drinks (3.9%). While Alcohol is driven by beer, Soft Drinks is driven by Coca-Cola – the single most prevalent sponsor – at 11 (one-third) of the participating teams.

Financial Services is driven Banks (3.1%) and Insurance (3.0%) brands while Consumer Services is driven by Gambling (the most prevalent sub sector at 5.0% share) and Specialised Consumer Services (2.2%). The latter is driven by fan token brand Socios who partner with 10 of the 32 teams – joint second alongside EA Sports behind Coca-Cola.

EA Sports contributes to Games being the second-most prevalent sub sector (4.3% share) behind Gambling and narrowly ahead of Specialist Professional Services (4.2%) which is admittedly a fairly wide sub sector. Games’ very high share among CL teams compared to almost all other sports is due to the sector’s endemic link with football games; EA Sports (through its FIFA series) Konami (eFootball game) and Sorare (fantasy football) all feature in the five most common sponsors.

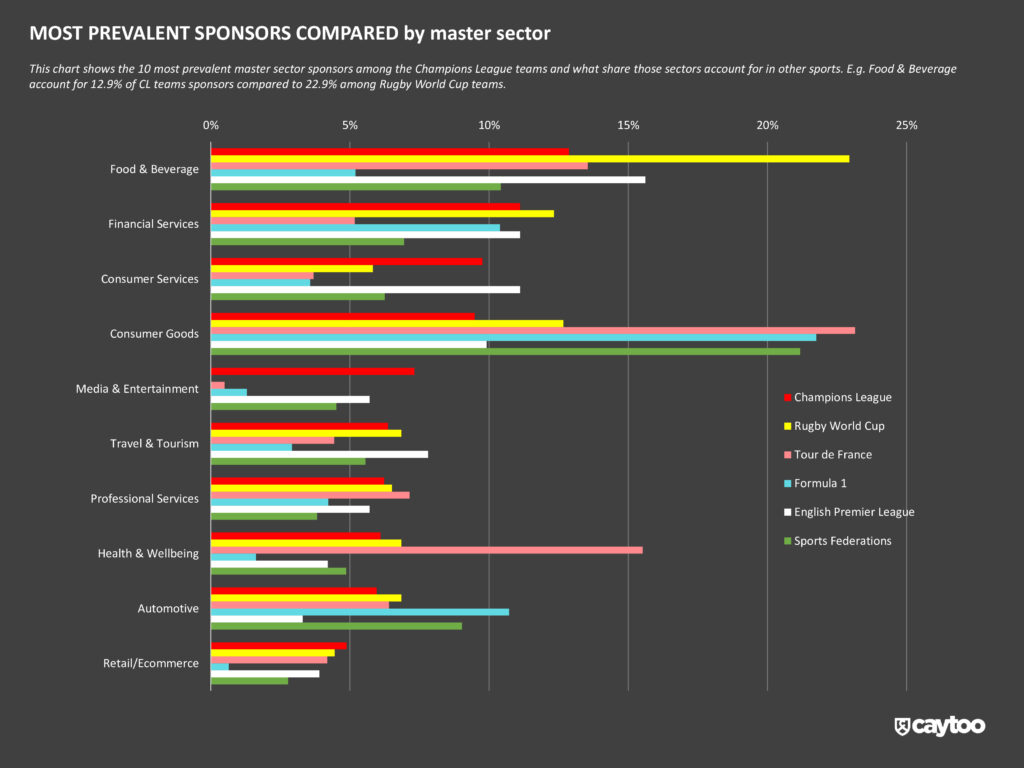

As a result, CL sponsors over-index on Media & Entertainment sponsorships (in which the Games sub sector resides) compared to other sports; the sector accounting for 7.3% among CL sponsors compared to 0% among Rugby World Cup Teams, 0.5% in The Tour de France, 1.3% in both Formula 1 and the MLB, and 2.5% in the NBA.

When compared to other sports, F&B’s share of CL sponsors is similar to cycling’s Tour de France but much lower than the likes of teams competing in the Rugby World Cup (22.9% share), baseball’s MLB (19.5%) and basketball’s NBA (18.2%). However, it is much higher than in Formula 1 (5.2%). CL sponsors also over-index slightly on Retail/Ecommerce compared to these other sports but nowhere near to the degree.

In contrast, CL teams tend to ‘under-index’ compared to other European-centric rights holders when it comes to attracting Consumer Goods sponsors. For instance, the sector accounts for 9.5% of CL sponsors compared to 23.2% in the Tour de France, 21.8% in Formula 1 and 12.7% among Rugby World Cup Teams. However, its share is higher than in the US-based MLB (6.2%) and NBA (8.0%).

It’s a similar story with the Automotive sector – although not to such a strong degree – with CL teams attracting a lower share compared to the European-centric rights holders but higher than the US-based counterparts.