iSportConnect Business Index: “What’s going on with Warner Bros.”

May 29, 2024

Carlo De Marchis “A Guy With A Scarf” pens down this month’s Business Index.

Global markets are strong and confidence has returned so there is naturally more green than red on our monthly index. The outstanding winners are Guild ESports but they are tiny so today let’s look at a long term decliner and talk Warner Bros. Discovery (WBD) where all is not rosy. The past few months have been a rollercoaster ride for Warner Bros. Discovery (WBD) and its investors. The media giant’s stock has experienced a significant decline, hitting an all-time low of $7.36 on Tuesday, May 1, 2024. In fact the longer view is truly troublesome since April 11 2022 when the media and streaming firm was formed from the $43-billion merger of Discovery Inc and assets of AT&T Inc. Initially this was to compete directly with the likes of Netflix and Disney. Since then WBD shares are down nearly 70% and as a reference, Disney is down 15% and Netflix is up more than 50%. Something isn’t working.

This recent plunge can be attributed to a combination of factors, including concerns over the potential loss of NBA broadcast rights and the company’s struggle to adapt to the rapidly evolving media landscape.

One of the primary reasons for the stock’s recent tumble is the looming threat of losing the NBA broadcast rights to NBCUniversal. According to a report in The Wall Street Journal, NBCUniversal is prepared to pay an average of about $2.5 billion a year to air NBA games, effectively doubling the current fee paid by WBD. This bid threatens to eclipse WBD, which has aired NBA games on its cable network TNT for many years.

The potential loss of the NBA rights could not come at a worse time for WBD CEO David Zaslav, who has been grappling with the challenges of selling Wall Street on his vision for a one-stop, one-size-fits-all streamer to compete with Netflix. Since WBD first began trading on Wall Street, the stock has lost roughly 70% of its value despite a huge rally in early 2021. While investors have been patient, shares plunging to a new all-time low on Tuesday is not a welcome development.

Moreover, WBD has made significant investments that hinge on maintaining the rights to NBA games. TNT has built a programming slate around the NBA, most notably the highly rated “Inside the NBA” show. Charles Barkley, a key figure on the show, recently signed a new, 10-year deal with WBD worth up to $200 million. Losing the NBA rights could jeopardize the value of these investments and make it harder for WBD to charge distributors for carriage of its channels.

The potential loss of the NBA rights also raises questions about WBD’s recently announced deal with Disney and Fox Corporation to launch a sports super-streamer. The absence of NBA games could throw aspects of this business partnership into question and undermine WBD’s pitch to consumers about live sports being a key differentiator for its flagship streaming service, Max.

While it’s possible that WBD will overtake NBCU’s bid or at least secure some NBA games, the current state of play is not a welcome development for Zaslav and chief financial officer Gunnar Wiedenfels, who have been known for their cost-conscious management of the company.

The optics of the situation are far from ideal, given that executives such as Zaslav and Wiedenfels have been handsomely compensated while investors have watched their assets evaporate over the years. According to recent financial disclosures, Zaslav’s 2023 compensation package grew to nearly $50 million, while Wiedenfels’ topped $17 million.

It’s important to note that WBD is not alone in facing these challenges. Legacy media companies are struggling to adapt to the rapidly changing media landscape, with consumers cutting the cord in favor of streaming options. Disney CEO Bob Iger has openly spoken about the numerous challenges he is navigating, and Paramount Global is engaged in merger talks with David Ellison’s Skydance Media as it fights to find a path forward for survival.

In this context, securing sports rights has become even more crucial for media companies. Live sports are one of the few remaining pillars supporting the traditional cable television package, which has been a lucrative revenue stream for companies like WBD. As legacy media companies search for audiences and try to entice the public to sign up for their streaming platforms, securing these sports rights is more important than ever.

For Zaslav and WBD, the battle for NBA rights could not come at a more inopportune time. With other aspects of the business struggling, the NBA becomes an even more critical asset. The potential loss of these rights, combined with the company’s ongoing challenges, has contributed to the significant decline in WBD’s stock price over the past few months.

However, a glimmer of hope has emerged in the form of a new streaming bundle announced by Disney Entertainment and Warner Bros. Discovery on May 8, 2024. The bundle, which includes Disney+, Hulu, and Max, is set to launch in the U.S. this summer, offering subscribers access to an unprecedented selection of content from the biggest and most beloved brands in entertainment. This partnership could help drive incremental subscribers and stronger retention for WBD, potentially offsetting some of the losses incurred by the potential loss of the NBA rights.

As WBD navigates these turbulent waters, it will be crucial for the company to adapt quickly to the changing media landscape, secure valuable content like the NBA rights, and convince investors of its long-term vision. The recently announced streaming bundle with Disney Entertainment could be a step in the right direction, but the company will need to continue to innovate and evolve to remain competitive in the rapidly changing media industry.

The tumultuous decline of Warner Bros. Discovery stock serves as a stark reminder of the challenges faced by legacy media companies in the age of streaming. As the battle for the NBA rights unfolds and WBD continues to grapple with its internal struggles, investors and industry watchers alike will be keeping a close eye on the company’s next moves. The success of the new streaming bundle and the outcome of the NBA rights negotiations will likely play a significant role in determining the future of WBD and its stock price.

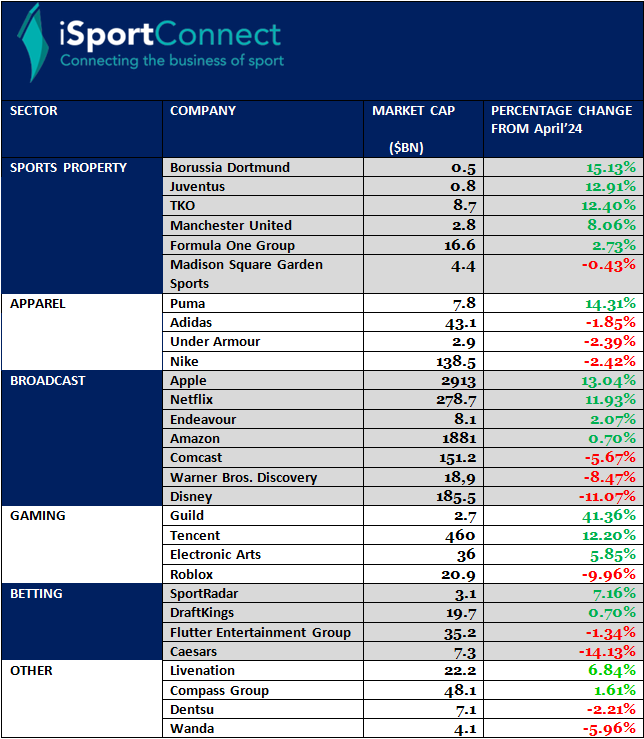

Here’s the full index: